Boosting ROI in Marketing Campaigns with Digital Asset Management

Utilize Launch Team’s Organizational Checklist for Brand Consistency and Streamlined Workflow How often do you find yourself or your team digging...

2 min read

Michele Nichols Tue, Oct 01, 2024

The medical technology market remains robust with continued growth- with the resurgence of pandemic deferred procedures, as well as continued demand for some pandemic-related products. Many market leaders are reassessing their go-to-market and sales strategies. Major drivers include corporate consolidation, evolving delivery models, and new end customers who expect increased service and engagement. The industry continues its move from a product-centric model to an increasingly customer-centric one.

In the post-Covid environment, leading companies are moving from a multichannel model to an omnichannel one. An omnichannel approach allows customers to interact seamlessly and with personalization across multiple digital and non-digital channels. This connection with customers before, during, and after a medical device product launch is critical to ensuring its success.

It’s challenging to “follow the money” in healthcare. As John Babitt of Ernst & Young says, “Now everyone’s the payer.” Whether your system is physician or hospital-based, the end customer could be the individual, employer, health insurance company, or another party. Therefore, establishing value is essential. The question today is not simply, “Is this technology better?” According to Babitt, the question is, “Is this technology better and is it worth it?”

Customer engagement is critical to generating sales, and it is often the difference between product launches that succeed and those that don’t. The bigger the company, the more difficult customer engagement becomes. GE Healthcare admits, “Customer engagement was our biggest problem. Our teams weren’t close enough to the customer.” GE worked to change its innovation model for medical devices to address this problem, which resulted in a two-year acceleration in time-to-market.

Medical devices are increasingly connected to both the internet and other devices, making great advancements in care and convenience and making them vulnerable to cyber-attacks just like any other device. Congress passed the Consolidated Appropriations Act, 2023 (H.R. 2617) in late 2022 to improve the cybersecurity of medical devices and to give the FDA the authority to establish and enforce standards (previously, there was no clear authority).

The FDA worked with the MITRE corporation (a non-profit) to develop a version of the Medical Device Cybersecurity Regional Incident Preparedness and Response Playbook on Nov. 15, 2022. The playbook contains tools, techniques, and resources to help prepare for and respond to a cybersecurity incident involving a medical device.

An aging population dealing with chronic diseases will continue to drive demand for medical devices and therefore drive investment.

According to RMS research in 2021, in vitro devices—ranging from blood glucose monitors to sophisticated diagnostic tools used in clinical laboratories to cancer screening tests—made up the largest portion of worldwide medical device sales, accounting for over $100 billion. Cardiology devices, focused on monitoring and treating heart disease, are the second largest segment, at nearly $60 billion. This is no surprise; the CDC cites heart disease as the leading cause of death in the United States, followed closely by cancer.

Keep in mind that not all of these tips may be applicable to every single situation—use your best judgment to determine which ones will work best for you.

Utilize Launch Team’s Organizational Checklist for Brand Consistency and Streamlined Workflow How often do you find yourself or your team digging...

2026 marks Launch Team’s 40th anniversary, and we’re celebrating decades of helping companies grow, adapt, and thrive. Leading up to this milestone,...

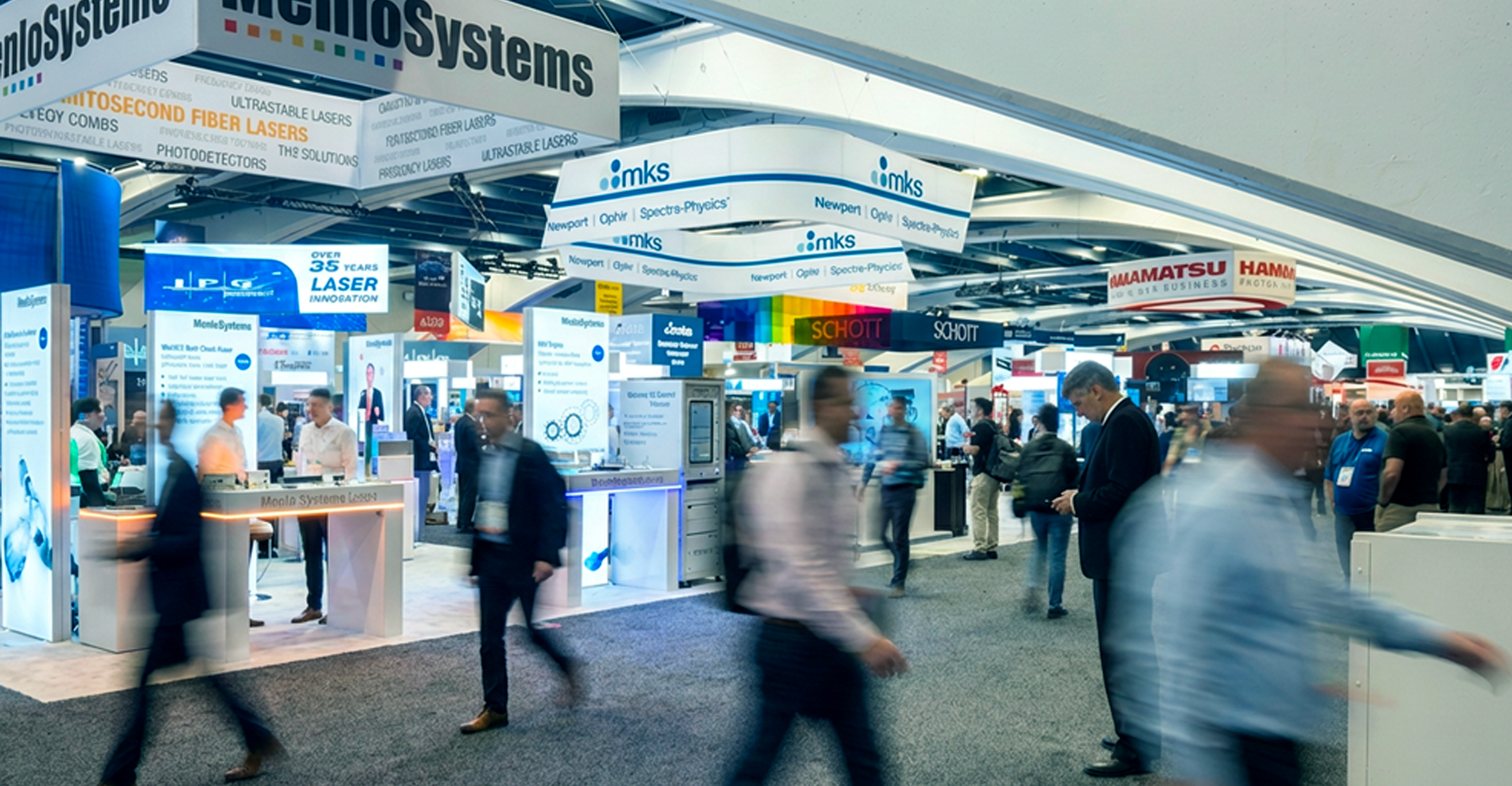

In the whirlwind of a large-scale trade show, a 10×10 booth can easily fade into the background. These compact booths often get overlooked and lost...