Small Tradeshow Budget and Booth, Big Impact: 4 Ways to Improve ROI

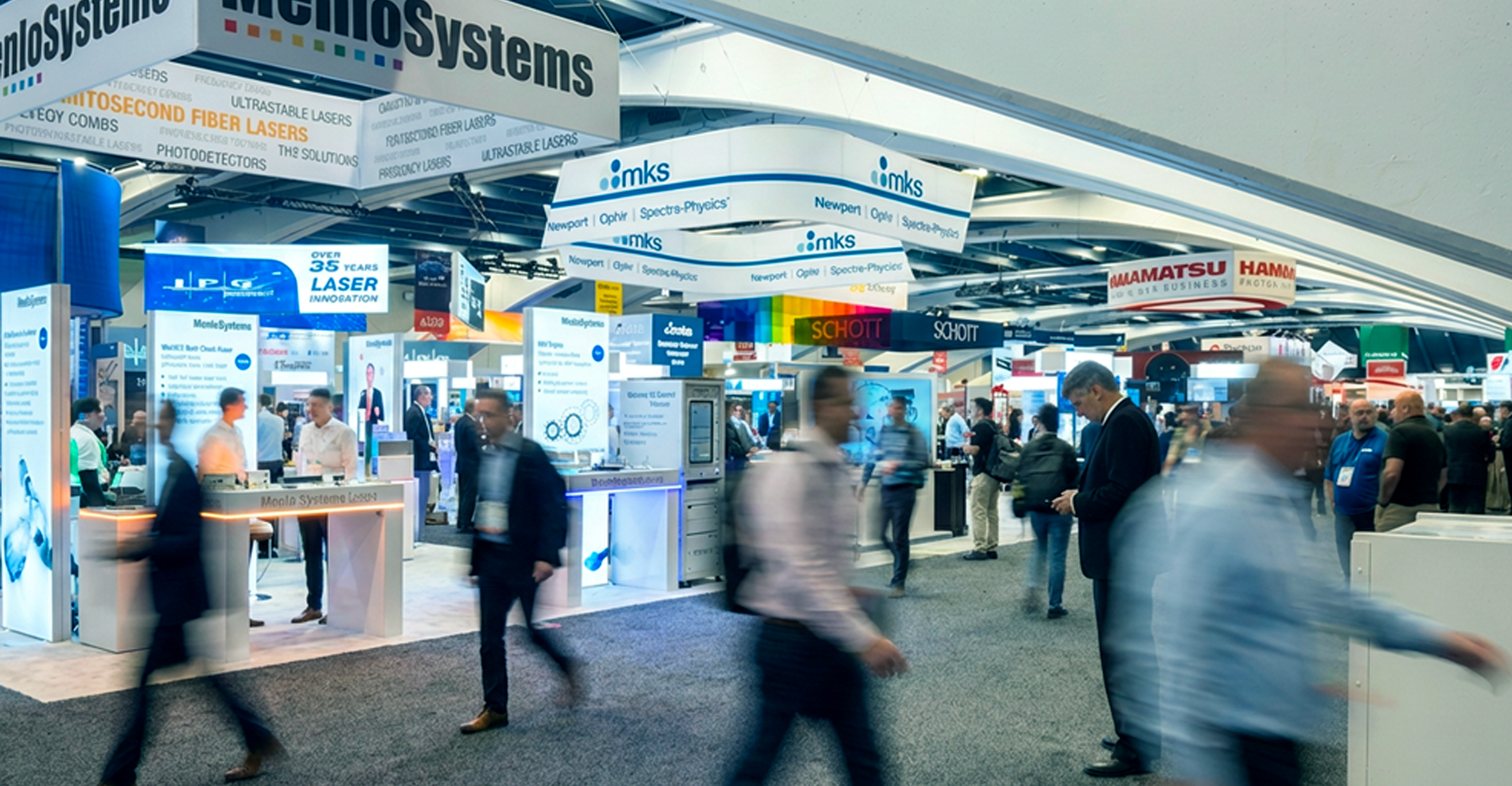

In the whirlwind of a large-scale trade show, a 10×10 booth can easily fade into the background. These compact booths often get overlooked and lost...

Expert panelists shared guidance for start-ups in the Investment session and Start-up Challenge. Here are some highlights:

Straight talk from Shahida Imani, Sujatha Ramanujan, and other panelists:

Looking for a strong marketing plan for your start-up business? We’ve created a guide with sales and marketing best practices for five different stages of growth.

In the whirlwind of a large-scale trade show, a 10×10 booth can easily fade into the background. These compact booths often get overlooked and lost...

Featuring insights from Starlet Smith, Lead Agile Coach at Alliant Energy Product development cycles are lengthening, increasing the risk of missing...

We work with B2B leaders every day who have extensive marketing data, but don't know what to make of it. It's hard to know you're on track to meet...