Boosting ROI in Marketing Campaigns with Digital Asset Management

Utilize Launch Team’s Organizational Checklist for Brand Consistency and Streamlined Workflow How often do you find yourself or your team digging...

Earlier this Fall, IDC released their 10th annual CMO Tech Marketing Benchmark Study, highlighting the budget allocation and trends of mid-sized and large tech companies. Marketing Profs also covered some of the results last month. While the IDC survey represents primarily mid-to large tech companies, there are insights and trends that apply to even the smallest of tech companies.

According to IDC's Rich Vancil, management teams are holding budgets tight until they see a pick up in demand. Survey findings show a 2% growth of marketing budgets in 2013 for larger tech companies. Dig a little deeper though and the results are quite different based on the size of your company. The following table shows budget growth rates by size of company (revenue).

| Revenue | Expected 2013 budget growth |

| <$500 Million | 15.8% |

| $1.0 to $2.9 Billion | 5.2% |

| >$10 Billion | 0.5% |

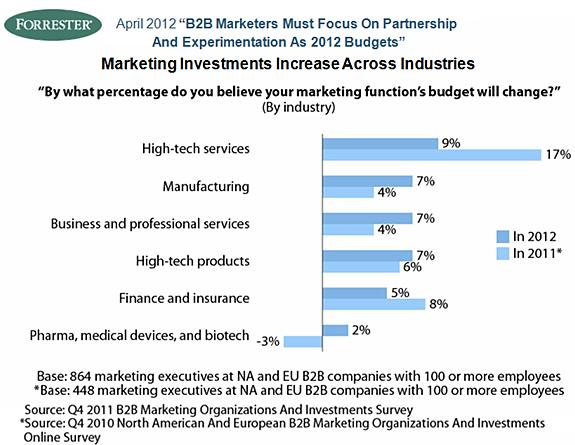

Earlier in 2012, Marketing Profs reported on a Forrester Research study of 864 B2B marketers about marketing budget changes for 2012. The results show budget growth in all industries.

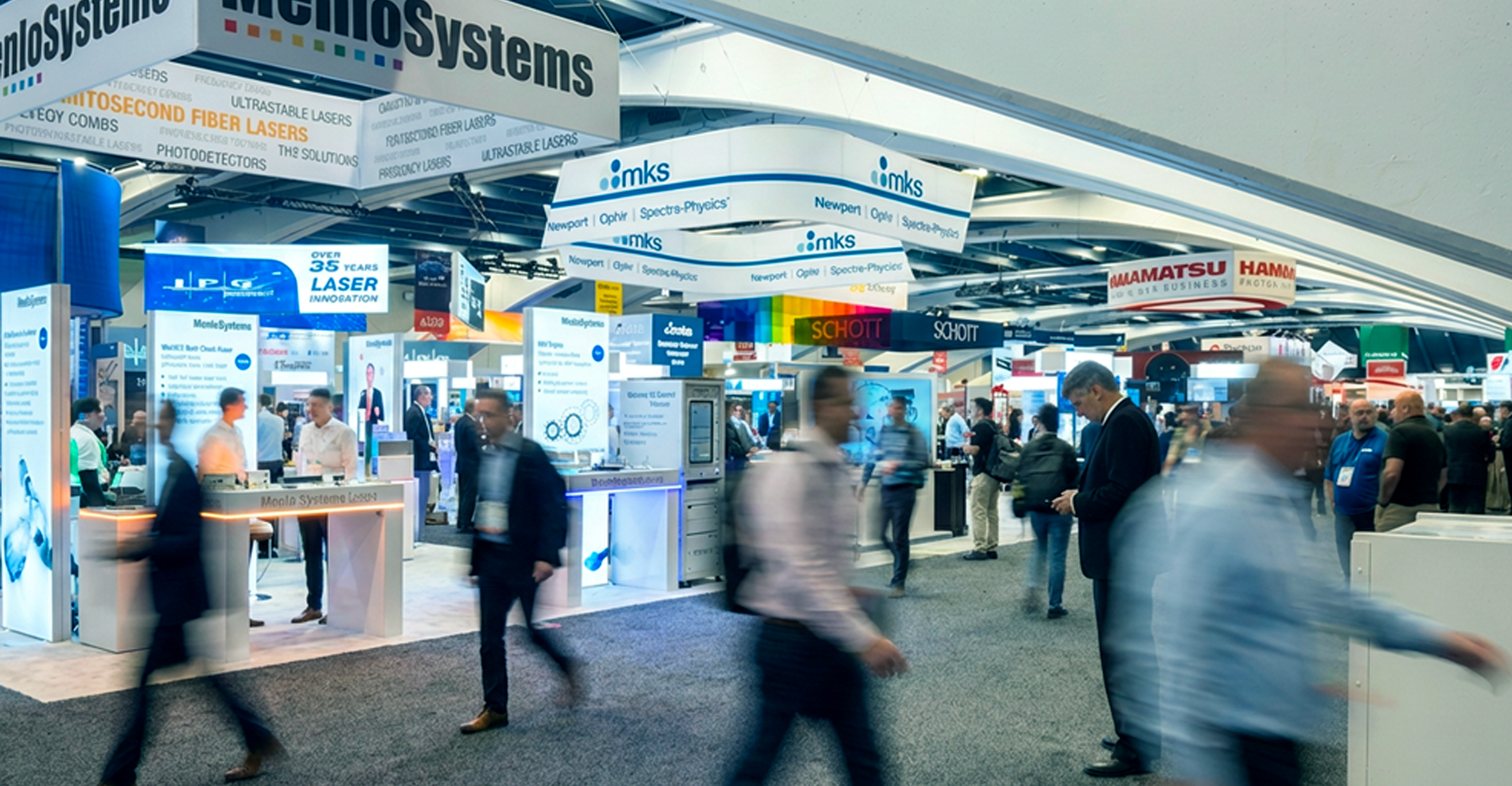

This year with clients, we're seeing modest overall marketing budget increases, with a shift to more online and content marketing tactics. Digital marketing investments often focus on extending the value of traditional marketing activities, such as trade shows and PR.

Growing from 26.4% in 2011 to 29.2% in 2012, the IDC report shows that digital marketing budget allocations continues to get a bigger piece of the overall budget pie. Continued growth and acceleration is expected in 2013.

| Digital Marketing Channels |

| Company website |

| Social media & networks |

| Email marketing |

| Search Ads (e.g., Google Ads) |

| Display Ads |

| Digital events (e.g., webinar, virtual trade show) |

| Marketing automation (e.g., HubSpot, Marketo) |

| Search Engine Optimization (SEO) |

Shifting to a more digital marketing mix, shows the commitment to adapting to changing behaviors of the B2B buyer. Business leaders have a high degree of interest in engaging customers on social media sites, however budget allocation represents a small slice of the overall and digital marketing budgets.

From IDC, we see the results of the overall 2012 budget allocation, with a blow out of digital marketing allocations.

With IDC data representing larger companies, your budget allocation categories might be different or simpler with less categories. Even so, the key takeaways for companies of all sizes are:

Underlying all marketing activities, clients focus on results that have a direct or indirect impact on sales. As a HubSpot certified partner, we offer our clients a proven platform that improves visibility and accountability of their marketing spend. The real value of HubSpot is the ease by which you can integrate all online activity, create linkage to off-line campaigns, automate lead nurturing activities, and pin point what's working and what's not.

This year is the first year IDC carved out marketing automation as its own budget slice. Companies are increasingly adopting marketing automation as a way to generate more leads online. Leveraging the web, social media, and other tools to attract and qualifies the right type of buyer for you business.

What's your experience?

Utilize Launch Team’s Organizational Checklist for Brand Consistency and Streamlined Workflow How often do you find yourself or your team digging...

2026 marks Launch Team’s 40th anniversary, and we’re celebrating decades of helping companies grow, adapt, and thrive. Leading up to this milestone,...

In the whirlwind of a large-scale trade show, a 10×10 booth can easily fade into the background. These compact booths often get overlooked and lost...