Small Tradeshow Budget and Booth, Big Impact: 4 Ways to Improve ROI

In the whirlwind of a large-scale trade show, a 10×10 booth can easily fade into the background. These compact booths often get overlooked and lost...

2 min read

Michele Nichols Mon, Oct 28, 2024

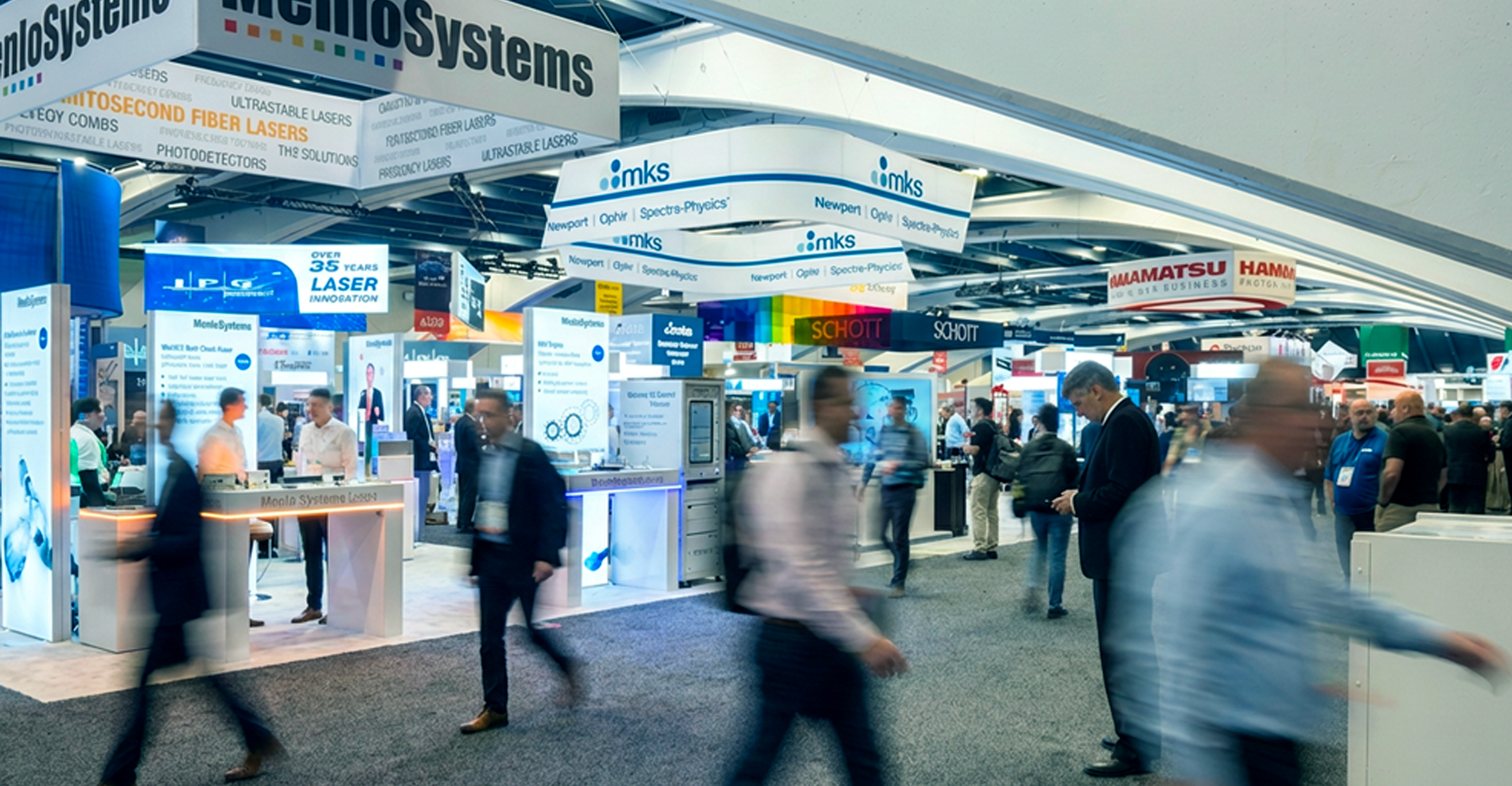

FABTECH, which spanned 3 exhibit halls and attracted over 30,000 attendees, is North America’s largest metal forming, fabricating, welding and finishing event—and offered a fascinating and forward-looking view at advanced manufacturing.

Launch President Michele Nichols was invited to present with other industry experts. From conversations with attendees, exhibitors and co-presenters, here’s an inside view at the concerns and market drivers facing US advanced manufacturing.

Seen and Heard at FABTECH:

FABTECH attendees were out in full force--especially in laser welding and automation. With the shift from traditional welding and subtractive manufacturing to venture capital inflow and investment in automation and additive manufacturing comes an ever-widening spectrum of sophistication and business models. From machinists to Italian suits, there’s no denying this industry is diversifying. Acquisition deal flow is a bit behind the highs of 2022, but there is a lot of pent-up activity and money on the sidelines as we head into 2024.

We see the tide changing in manufacturers' customer base as well.

Companies who believe they’re well-known to their customers may be surprised to find how quickly their employee and customer base is changing. Our President, Michele Nichols, spoke on two topics, both of which reflect this shift:

Emerging Leaders Workshop: Manufacturing companies sent their next-gen leaders to learn how to position themselves, and their companies, for the changes ahead, and build the resilience and internal communication skills needed to help guide their employees through the market changes ahead.

Maximizing Growth with CRM, AI and Automation in Sales and Marketing: Companies looking to scale with limited access to qualified technical sales talent and a changing customer base are eager to embrace sales efficiencies from CRM and AI. In the Q&A from our talk, most attendees were curious about AI applications that might fit their sales and marketing strategy, but most of their immediate needs were in CRM optimization and adoption.

Today, 76% of manufacturers have a CRM, but fully 2/3 of those implementations fail to deliver on the initial business goals. Questions centered around how to motivate leadership and sales teams to move beyond the spreadsheet, ensure accurate customer data and forecasts, and how to create a sales process that fits today's customer expectations. Technologies like AI, automation and CRM can drive revenue and margin--but not without people and process.

Miss the presentations? Download the slides:

Miss the presentations? Download the slides:Maximize Growth with CRM & AI Strategies

Positioning for Challenging Times

Low unemployment rates exacerbate an industry-wide concern over workforce development. Advanced manufacturing companies will have to work particularly hard on internal communications to retain employees through times of growth, ensuring that everyone has a voice and understands the company direction, not just the front office. Engaged employees are retained and productive employees, and the same resources and tools you use for your external marketing may come in handy in helping your employees feel the impact of their work to the end consumer.

Could you use an outside perspective on how your team is adapting to these changes in the market? Request a consultation!

In the whirlwind of a large-scale trade show, a 10×10 booth can easily fade into the background. These compact booths often get overlooked and lost...

Featuring insights from Starlet Smith, Lead Agile Coach at Alliant Energy Product development cycles are lengthening, increasing the risk of missing...

We work with B2B leaders every day who have extensive marketing data, but don't know what to make of it. It's hard to know you're on track to meet...