Small Tradeshow Budget and Booth, Big Impact: 4 Ways to Improve ROI

In the whirlwind of a large-scale trade show, a 10×10 booth can easily fade into the background. These compact booths often get overlooked and lost...

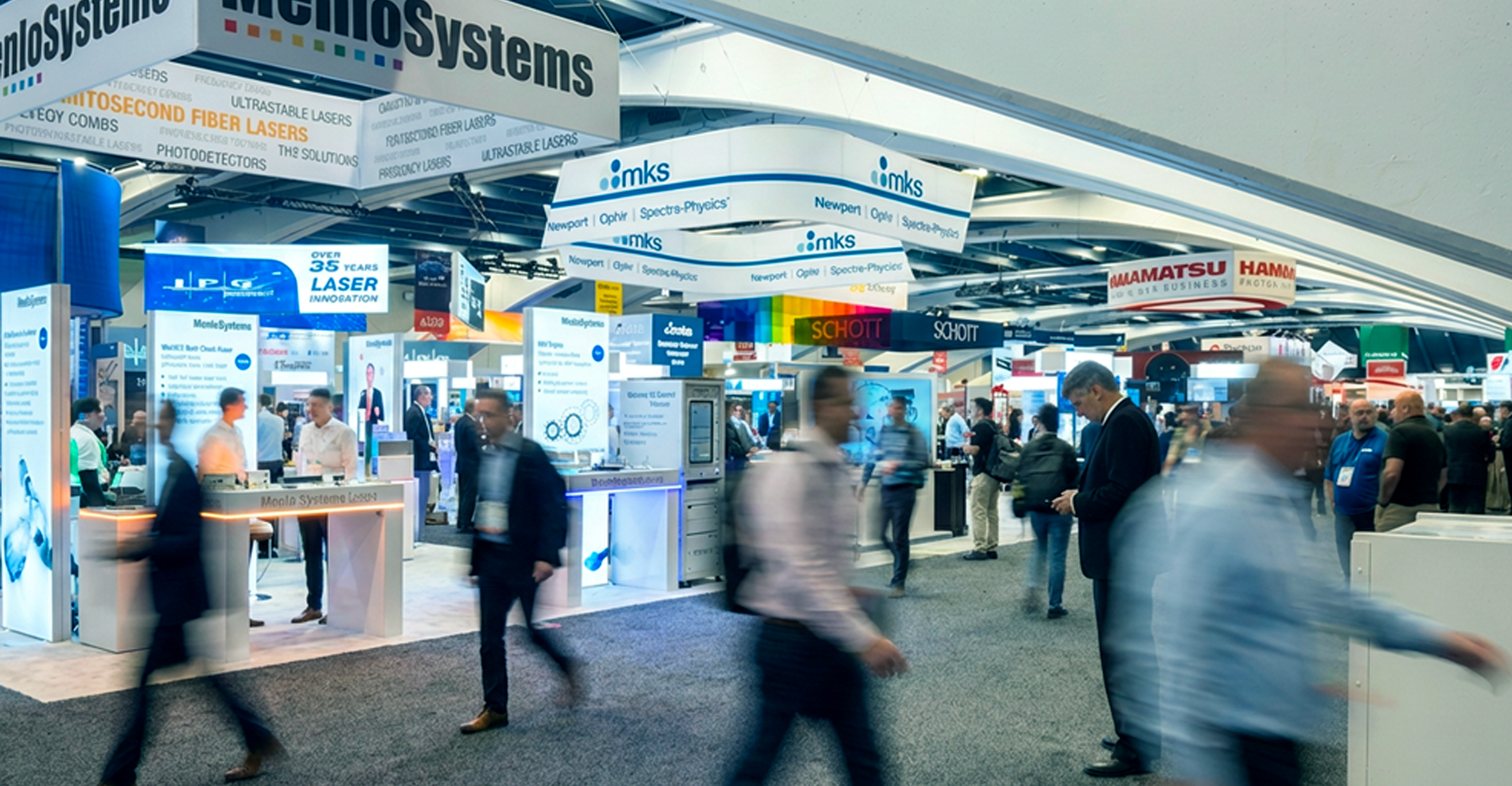

This February, I was honored to present at SPIE Photonics West with other photonics industry experts. With business development (BD) and marketing tied up on the exhibition floor, sessions like our AR/VR Market Outlook, Photonics Outlook, and LFW’s Laser Marketplace, tended to attract C-level thinkers. Their strategies, experiences, and questions revealed some trends:

Allen Nogee, President, Laser Market Research, confirmed some surprisingly lackluster 2019 results. While demand and the general market appeared promising, laser companies missed the mark, with a 1.7% growth in GDP in the US, behind inflation at 2.3%.

Why did we miss? To list a few, we had delays of the Boeing 737, a 12% drop in materials processing, and slowing growth in China (a country that consumes more lasers than any other). Perhaps the most impactful is that many companies over-stocked at the end of 2018 in anticipation of tariffs. While the larger laser companies were able to move manufacturing lines, smaller companies had fewer options and were hit much harder.

Of course, controlled growth and a catch-up year in 2019 isn’t a bad thing. However, after 2 years of slowing growth from the all-time 2017 high, companies will need to position for high-value capabilities, emerging markets, and fight for market share to maintain growth rates and margins.

There is growing uncertainty with political shifts, worldwide health issues, changing demand, and more industry movers ahead. Regardless of the industry’s and your company’s 2019 results, these market changes are worth a discussion:

We are projecting a $17.3B 2020 revenue and 11.5% growth in the laser market. What is fueling this growth? Three major sectors:

Allen’s predictions include:

Read more from Allen Nogee here.

In a leadership panel that included II-VI, Trumpf, Excelitas, and others, they agreed that the biggest challenges the industry will face in 2020 include:

Through our work in optics, photonics, lasers, and upstream into medical device and aerospace/defense, I have come across some trends and drivers worth noting:

A forward-looking eye toward your customers’ emerging requirements and a willingness to reposition your company to capitalize on opportunities like these can help you to beat market downturns and commoditization in traditional markets.

Want more information on the market and how you can adapt your business model?

We are a multi-dimensional, highly focused marketing firm that has helped companies in technical and engineering-driven industries succeed. We've been doing this for over 30 years, increasing and improving our offerings along the way. Our team's backgrounds include optics, chemistry, biology paired with a core business and marketing focus. This allows our team a unique understanding of your business, the decision makers you work with, and the engineers who will evaluate your solution.

In the whirlwind of a large-scale trade show, a 10×10 booth can easily fade into the background. These compact booths often get overlooked and lost...

Featuring insights from Starlet Smith, Lead Agile Coach at Alliant Energy Product development cycles are lengthening, increasing the risk of missing...

We work with B2B leaders every day who have extensive marketing data, but don't know what to make of it. It's hard to know you're on track to meet...