Small Tradeshow Budget and Booth, Big Impact: 4 Ways to Improve ROI

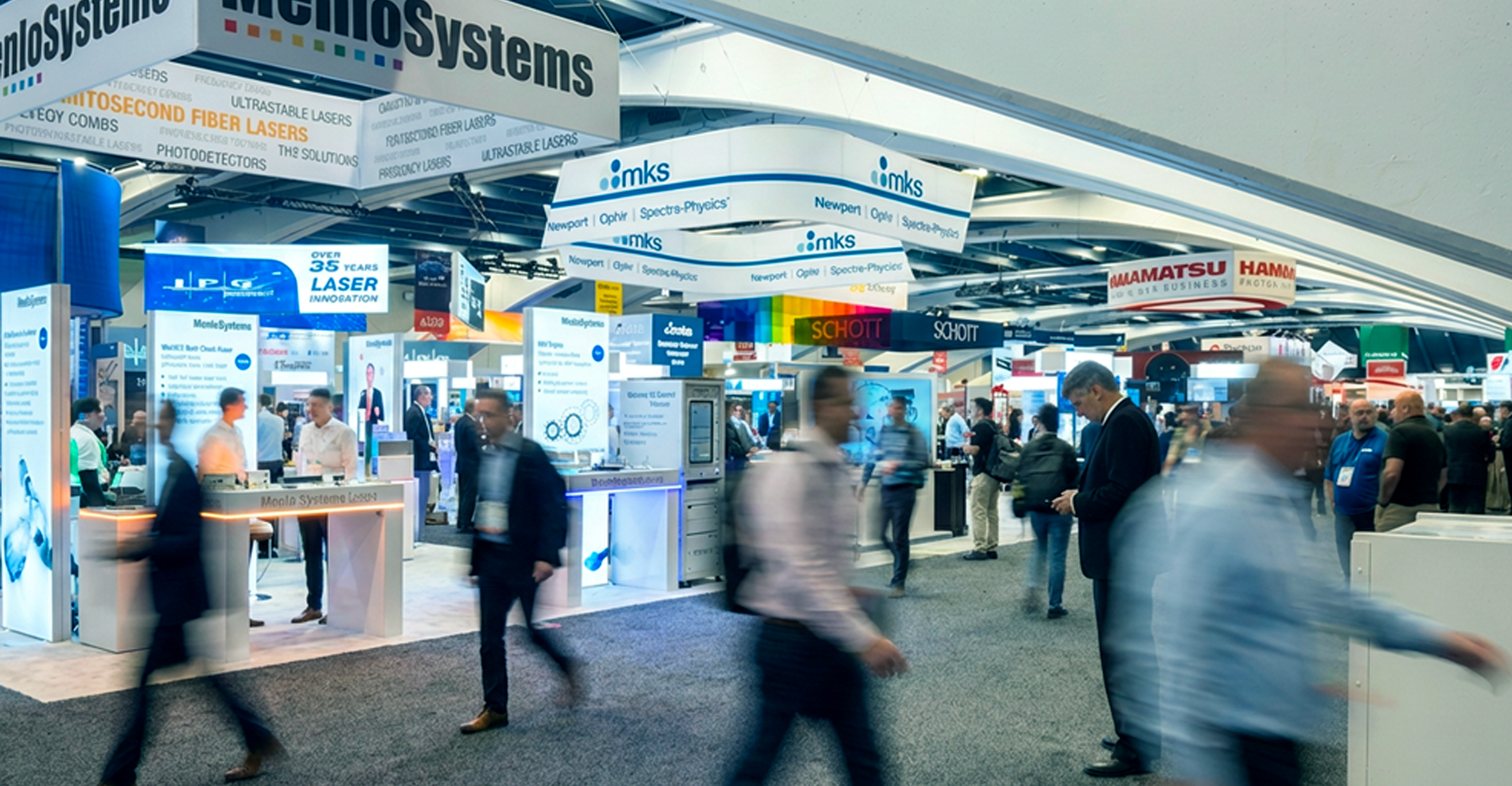

In the whirlwind of a large-scale trade show, a 10×10 booth can easily fade into the background. These compact booths often get overlooked and lost...

Whether you are planning to exit your company or accelerate growth through acquisitions in the next few years, your marketing foundation and strategy will significantly impact valuation and success after a major sale. This 3-part series will walk you through the key stages:

Launch Team has worked with B2B technology companies, from start-up to Fortune 100, for nearly 40 years. This guide will provide general guidance suited for companies at each stage. Specific benchmark data is suited to B2B technology companies serving niche but global markets.

| Preparing for Exit | M&A Transition | Acquisition Integration |

Success factors:

|

Success factors:

|

Success factors:

|

Well before marketing your company for sale, there are strategies to improve your multiplier. Most deals will look at revenue and profits for three years, and your growth trend during this time. Lay the groundwork for strong numbers and understand the drivers of valuation and goodwill.

Buyers will be looking for:

Above all, rigorous, data-driven sales and marketing can help you prove demand in the market, and the value of your company’s brand and strategic positioning.

As you build a marketing strategy for exit planning, focus on positioning your company and products as a valuable acquisition target, establishing market leadership, clear competitive advantage, and growth potential.

Assessing your marketing strategy well in advance of an exit ensures you can exit when the company is doing well, not when you need to, at a premium. This will also allow you to drive the needed leads for a strong three-year growth trend.

For smaller companies, preparing for an exit may mean shifting brand recognition from you, the leader, to the company. Through our experience of helping CEOs separate from their companies, we have found the best way to prioritize your brand is to make a short list of promising acquirers and consider the drivers for each.

If it’s a strength to be in a particular high-growth market, consider shifting your marketing strategy to prioritize growth and brand awareness. If there is a specific product line or technology you want to tap into, you may want to invest in product naming and branding to help it stand on its own. You may also want to make process changes to ensure you have product-specific sales data to demonstrate future opportunities.

A strong brand reputation drives up goodwill and positions for your company to attract strategic buyers. Start by establishing:

To start building an optimized sales pipeline, you will need to understand which size companies demand the highest multiplier in your industry. Based on that, you can set a profit and revenue target, allowing you to make a plan to reach it. Working backward, you’ll be able to set specific growth targets and key sales and marketing metrics such as average deal size, quotes per month, leads and web traffic. Consider that this year’s marketing determines next year’s sales, which may make your timeline for action more concrete.

In today’s environment, sales and marketing data may face nearly the same scrutiny as financial due diligence. Clean data and established processes will help to make the business case for a successful transaction. Strive for consistent CRM adoption, with your CRM the source of truth for customer relationships, contact database, opportunities and contracts.

Make sure you have the metrics in place to demonstrate marketing growth and an accurate forecast. Traffic and lead trend lines should be in line with your growth projections. Consider targeted marketing strategies like account-based marketing (ABM) to go after key accounts in high-growth markets, or of particular interest to an acquirer.

For example, if you believe a European competitor would like to enter the US medical device market, target the top 10 US medical device companies. Your brand presence may be demonstrated by contacts, inbound leads, and followers within this segment. Consider tightening your market positioning to create a unique value proposition for this target.

Scenario:

Your company, NewCo, has now been in business for six years. Its growth, both domestic and international, has been explosive. You decide it is time to sell while the company is strong. You entertain offers from both domestic and foreign buyers, eventually settling on a sale to a subsidiary of your UK contractor. Negotiations and diligence activities are at a fever pitch, with teams of business pros and lawyers exploring every aspect of NewCo’s business.

Consider:

It’s critical at this point that you’re not married to the deal. Too many companies accept a bad deal because they weren’t prepared with other options. Look at business sale opportunities as a pipeline as well. If you’ve been building your brand and sale pipeline, you’ve raised your valuation and proven to the buyer that the business, without you, is a stand-alone asset.

Sales & Marketing

If you’re being acquired by a customer, look carefully at what you will sell. Are you an internal provider, or will you maintain your customer base? Which customers are at risk? Craft a strong communication plan early. Remember to include all your audiences: customers, investors, and your own employees. The ability to retain key experts after the close adds to your value and the likelihood of your success.

Looking for specific guidance on marketing and sales priorities in exit planning? Book a confidential consult.

Download the M&A Marketing Strategy Whitepaper for a full guide on hitting your divestiture or acquisition targets.

In the whirlwind of a large-scale trade show, a 10×10 booth can easily fade into the background. These compact booths often get overlooked and lost...

Featuring insights from Starlet Smith, Lead Agile Coach at Alliant Energy Product development cycles are lengthening, increasing the risk of missing...

We work with B2B leaders every day who have extensive marketing data, but don't know what to make of it. It's hard to know you're on track to meet...