Small Tradeshow Budget and Booth, Big Impact: 4 Ways to Improve ROI

In the whirlwind of a large-scale trade show, a 10×10 booth can easily fade into the background. These compact booths often get overlooked and lost...

2 min read

Michele Nichols Tue, Sep 26, 2017

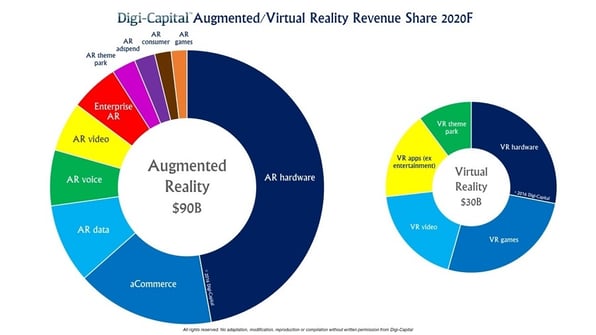

While virtual reality promised and failed to hit 2016 expectations, market projections still show that augmented reality and virtual reality will reach $108B by 2021. Consumer electronics are a high-volume opportunity for U.S. optical manufacturers, but they often remain elusive due to cost constraints. Does augmented reality (AR) or virtual reality (VR) offer some optics and photonics companies a stronghold? Let’s break it down.

While we tend to think of gaming and entertainment, these segments represent less than half the market projections. Training, inspection, and health applications provide a far broader mix of end users and a range of emerging requirements.

Regulatory controls in healthcare and military segments, as well as precision concerns in engineering, may offer U.S. manufacturers an advantage. Many of the optics companies we know are actively engaged in prototyping for AR and VR, but full production depends on widespread adoption.

Widespread adoption is understandably slow, due to interdependencies such as:

VR platforms like Facebook's Oculus Rift, HTC Vive, and Samsung Galaxy's Gear VR all launched with plenty of barriers, but remain promising. The "hero device" is much clearer for AR, though. Even with the re-emergence of Google Glass, AR is almost certainly going to be smartphone based. What's more, AR and the optics behind it offer phone manufacturers a critical innovation to overcome slowing replacement cycles.

Optical designers and manufacturers stand to capitalize on this emerging marketspace if they can prove to offer an advantage in:

Specifically, AR/VR is a significant opportunity for companies who offer core competencies in:

The large field of view required for adoption of consumer AR/VR presents a classic industrial design challenge—how to meet cost, size, and weight limitations. Investment is certainly there to fuel this research. In July, WaveOptics raised $15.5M for its display technology.

Beyond the end user apparatus, creator technologies represent opportunities:

Regardless of where your capabilities match with market opportunity, do your research, understand customer drivers, and be sure to qualify opportunities to understand scale-up timing and dependencies.

Launching a new product? Download our Product Launch Checklist for help planning key activities and timing.

In the whirlwind of a large-scale trade show, a 10×10 booth can easily fade into the background. These compact booths often get overlooked and lost...

Featuring insights from Starlet Smith, Lead Agile Coach at Alliant Energy Product development cycles are lengthening, increasing the risk of missing...

We work with B2B leaders every day who have extensive marketing data, but don't know what to make of it. It's hard to know you're on track to meet...