Small Tradeshow Budget and Booth, Big Impact: 4 Ways to Improve ROI

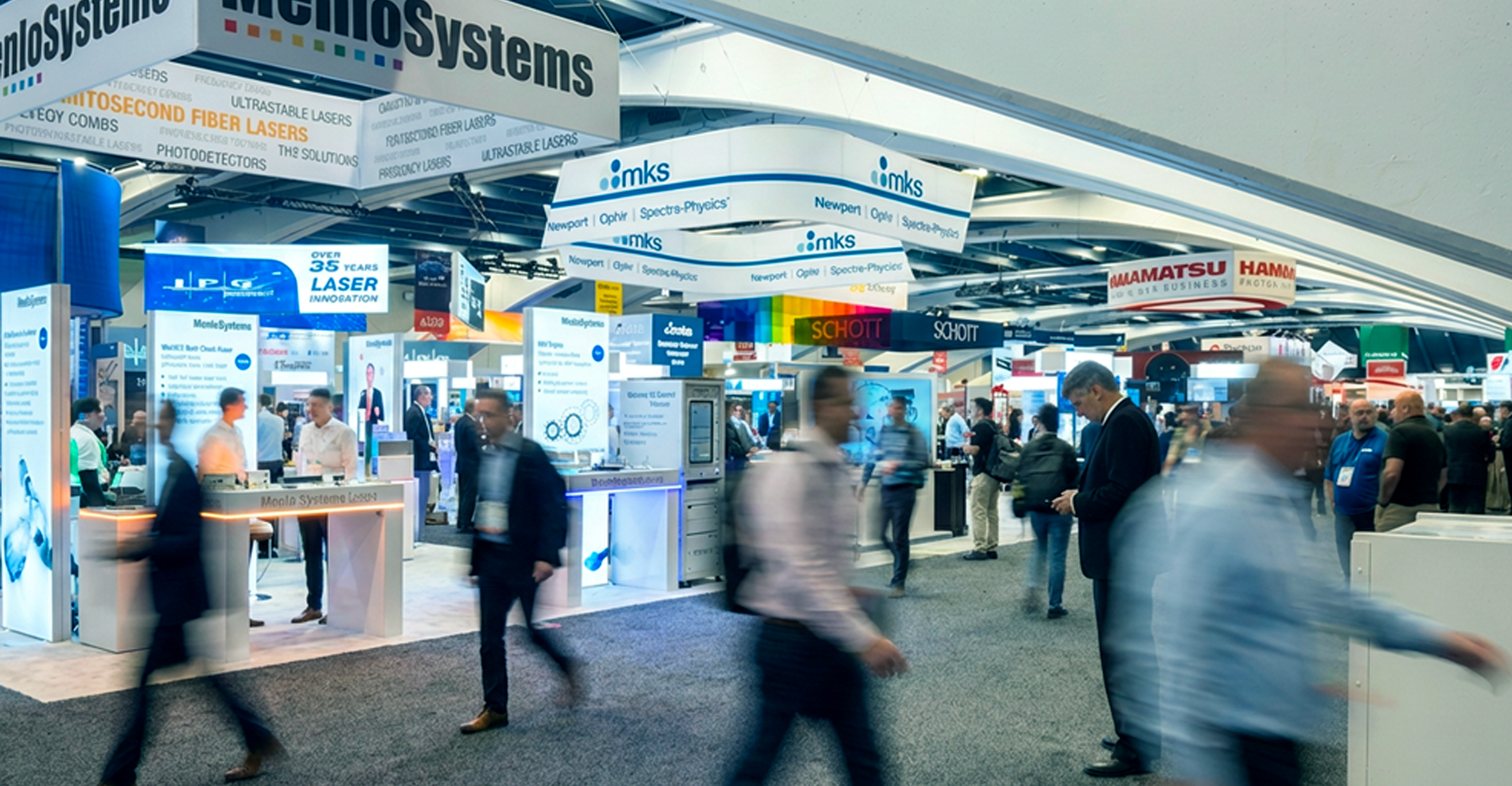

In the whirlwind of a large-scale trade show, a 10×10 booth can easily fade into the background. These compact booths often get overlooked and lost...

The Coronavirus Aid, Relief, and Economic Security Act (CARES Act), is a $2.2 trillion package to address the coronavirus crisis. There are many programs available to help small and medium sized businesses (SMB) adjust and survive during this time. The U.S. Senate Committee on Small Business and Entrepreneurship has put together a guide to the CARES act, which you can download here. Some of the resources available for small businesses include:

In addition, many companies in the private sector are offering help to businesses.

These include:

___

Last updated 04/03/2020

Check back for additional updates as the situation progresses.

We are a multi-dimensional, highly focused marketing firm that has helped companies in technical and engineering-driven industries succeed. We've been doing this for over 30 years, increasing and improving our offerings along the way. Our team's backgrounds include optics, chemistry, biology paired with a core business and marketing focus. This allows our team a unique understanding of your business, the decision makers you work with, and the engineers who will evaluate your solution.

In the whirlwind of a large-scale trade show, a 10×10 booth can easily fade into the background. These compact booths often get overlooked and lost...

Featuring insights from Starlet Smith, Lead Agile Coach at Alliant Energy Product development cycles are lengthening, increasing the risk of missing...

We work with B2B leaders every day who have extensive marketing data, but don't know what to make of it. It's hard to know you're on track to meet...